Suppliers can match Japanese quality but with more cost efficiency

Living up to Taiwan’s reputation of “Kingdom of Hand Tools,” local suppliers of auto repair tools and equipment are increasingly known for long-term dedication to R&D and branding. Such strategies, coupled with unwillingness to compromise competing against emerging rivals and realizing the danger of market erosion due to underselling, most Taiwanese suppliers are trying to move upmarket to take on and replace once-stronger counterparts especially from Japan and Europe.

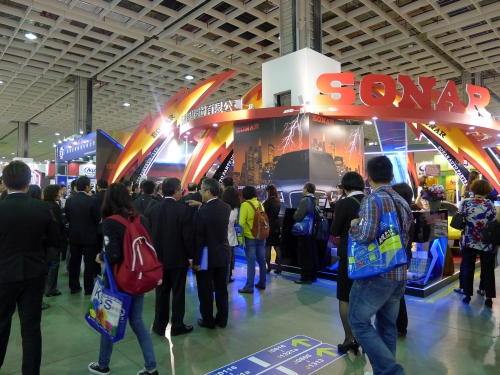

Evidence of this trend has been easy to find at major international auto-parts shows, where Taiwanese repair-tool makers have been showing up in higher numbers than Japanese and European players, especially in the past few years.

Among Taiwanese companies big and small, the verdict is the same: Japanese counterparts are losing shares in the higher-level professional repair-tool market. Made-in-Japan auto tools are well-known for quality, durability, precision, and functionality, which Taiwanese players are matching but backed with more competitive prices.

The majority of Taiwanese auto repair tool and equipment companies will showcase innovative, functional products for professional markets and even-higher industrial applications at the upcoming 2013 Taipei AMPA. This steady rise in the industry value chain is the result of long-term investment in upgrading product quality and functionality to meet the most stringent requirements of production lines in various industries.

Core Advantages

Since the global meltdown in 2008 and resulting weaker consumer confidence, the global performance-tuning auto-parts market has sagged, which is exasperated by automakers trying to spice up product competitiveness with enhanced engine output and exterior styling. High fuel prices, unemployment in the USA and EU and uncertain prospects have all impacted yearning to spend on faster, fancier cars.

However, many Taiwanese tuning-parts suppliers have done well due to several reasons. A local supplier points out: “American, European, and Japanese customers have increasingly returned to us after experiencing unpleasantness and frustrations in doing business with Chinese companies. Taiwanese tuning-parts suppliers’ core advantages include being accountable for product quality and creditworthiness. With high product reliability, tactile sense, satisfactory service, and on-time delivery, we can retain competitiveness in the global high-end market despite the lull in the global market.”

In many cases, shipments of high-end Taiwan-made performance parts have grown rapidly over the past few years, implying that quality and functionality, not low prices, are top priorities in the performance-parts market. Such experience tells global buyers that the quality of Taiwan-made performance parts is unmatched by Chinese counterparts; in addition, local manufacturers constantly upgrade innovation capabilities and production techniques to maintain their lead.

(Source:www.taipeiampa.com.tw)

Click “Industry News” to read more news.